Some Known Questions About Hard Money Georgia.

Wiki Article

Hard Money Georgia Can Be Fun For Anyone

Table of ContentsThe Main Principles Of Hard Money Georgia The Definitive Guide for Hard Money GeorgiaWhat Does Hard Money Georgia Mean?An Unbiased View of Hard Money Georgia

As you can see, private cash loans are exceptionally flexible. Nonetheless, it might be argued that private finances can put both the lender and also consumer in a sticky circumstance. hard money georgia. For instance, state both celebrations are brand-new to real estate financial investment. They may not recognize a lot, but they are close to each various other so wish to help each other out.

In spite of them needing to fulfill particular requirements, private lending is not as managed as difficult money financings (in some situations, it's not regulated at all).- Experienced capitalists recognize the benefits of complimenting their exclusive cash sources with a tough money lender.

The 9-Minute Rule for Hard Money Georgia

Above all, they're certified to lend to actual estate capitalists. Arguably a mild disadvantage with a tough money lender associates to one of the features that attaches private and also difficult money finances regulation.Depending on exactly how you look at it, this is also a strength. It's what makes hard cash lenders the safer option of both for an initial time capitalist and the factor that smart financiers remain to go down this course. WE LEND USES A SERIES OF PROGRAMS TO FIT EVERY KIND OF RESIDENTIAL INVESTOR.

The Basic Principles Of Hard Money Georgia

Though it's generally possible to get these kinds of finances from exclusive lenders that do not have the very same demands as typical lending institutions, these personal loans can be more costly and less beneficial for debtors, because the risk is a lot greater. Standard lending institutions will take an extensive appearance at your whole monetary scenario, including your earnings, the amount of financial debt you owe various other lenders, your credit scores history, your various other possessions (consisting of money books) as well as the dimension of your down payment.

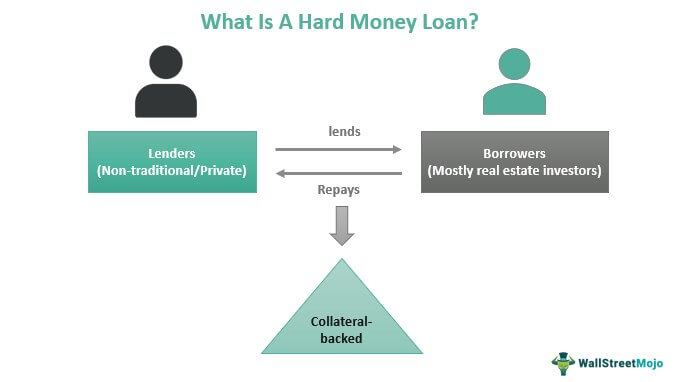

Difficult cash financings have numerous benefits over organization car loans from financial institutions and various other mainstream lenders. Are tough cash car loans worth it? Under the best scenarios absolutely.Fast financing can be the distinction in the success or failing of a possibility. Difficult cash lenders can transform a financing application right into offered cash money in an issue of days. Do tough cash lenders inspect credit More hints score? Yes, yet they focus on security over all else. They do not examine a customer's credit merit in the very same way as more controlled sources of funds. Reduced credit rating and also some adverse marks in debtors'economic histories play a smaller role in the lender's approval choice. In instance of default, the loan provider must be assured that the profits from sale of the property will be enough to redeem the loan's overdue principal equilibrium. To some extent, also the debtor's capability to settle the loan during the term is less essential than other determining factors. However, the lender needs to make sure the borrower can make the required repayments. Less state as well as federal regulations control difficult cash lending institutions, which enables for this versatility. Since of the Dodd-Frank Act, difficult money loan providers typically do not lend for the acquisition of a key residence. Tough cash loans are a type of alternate funding

that can be made use of genuine estate investment possibilities. Unlike typical financings, which are provided by banks or various other banks and are based mainly on the debtor's creditworthiness as well as income, tough cash finances are issued by personal financiers or companies and also are based mostly on the value of the residential or commercial property being made use of as security. It provides the debtor an option to the common home mortgage programs or standard loan providers. One of the most typical use these financings are with solution & turns and also short-term funding requirements. The hard money financings that we provide are raised with small individual financiers, hedge funds, and various other private establishments. Due to the danger taken by the funding service providers, rate of interest are normally higher than the typical home mortgage. Our products have shorter terms and also are normally for 6 months to 5 years, with interest just choices and also are not meant to be a long-term funding service. Personalized Home Loan Hard Money Lending get more Programs Include the adhering to main program: 1-4 Device Residential Quality including Condominiums, townhouses, apartment residences, as well as various other distinct residential or commercial properties. This is because tough money lending institutions are primarily focused on the value of the home, instead of the debtor's credit reliability or income. Consequently, tough cash loans are usually utilized by investor who require to secure funding quickly, such as when it comes to a repair as well as flip or a brief sale. This consists of single-family houses, multi-unit buildings, business buildings, and even land.

Hard Money Georgia Fundamentals Explained

Hard money car loans generally have higher interest prices and this hyperlink also charges than typical loans, as well as have shorter terms. One excellent advantage is that the finances are simpler to access; for that reason, if you do not fulfillthe qualifications of the conventional lenderTraditional lending institution can easily access conveniently loan without undergoing rigorous paperwork. A difficult money finance is a loan collateralized by a difficult possession (in most situations this would be actual estate).Report this wiki page