Facts About Atlanta Hard Money Lenders Revealed

Wiki Article

The 7-Second Trick For Atlanta Hard Money Lenders

Table of ContentsThe smart Trick of Atlanta Hard Money Lenders That Nobody is Talking AboutAtlanta Hard Money Lenders Can Be Fun For AnyoneWhat Does Atlanta Hard Money Lenders Mean?Getting My Atlanta Hard Money Lenders To WorkThe smart Trick of Atlanta Hard Money Lenders That Nobody is Talking AboutRumored Buzz on Atlanta Hard Money Lenders

In most cases the authorization for the tough cash lending can take area in just one day. The difficult money lender is mosting likely to think about the residential or commercial property, the amount of deposit or equity the debtor will have in the building, the consumer's experience (if applicable), the exit technique for the residential property as well as make certain the borrower has some cash money books in order to make the monthly lending settlements.Genuine estate capitalists that haven't previously used difficult money will be impressed at exactly how quickly difficult cash financings are funded compared to financial institutions. Compare that with 30+ days it takes for a financial institution to fund. This speedy financing has actually conserved many actual estate financiers who have actually been in escrow just to have their initial lending institution draw out or merely not deliver.

Their list of demands increases annually and several of them seem arbitrary. Banks likewise have a listing of issues that will certainly elevate a warning and also stop them from even thinking about offering to a debtor such as current foreclosures, brief sales, lending adjustments, as well as insolvencies. Negative credit scores is an additional element that will certainly stop a bank from lending to a borrower.

The 2-Minute Rule for Atlanta Hard Money Lenders

Fortunately for actual estate financiers who may presently have several of these issues on their record, difficult cash lending institutions are still able to lend to them. The tough cash loan providers can lend to customers with concerns as long as the consumer has sufficient deposit or equity (at least 25-30%) in the residential property.When it comes to a possible borrower who intends to buy a key house with an owner-occupied hard money lending via a personal home mortgage loan provider, the consumer can originally buy a building with difficult cash and after that function to repair any kind of problems or wait the essential amount of time to remove the issues.

Financial institutions are likewise resistant to offer home mortgage to consumers that are freelance or currently do not have the required 2 years of work background at their existing placement. The consumers might be an ideal prospect for the funding in every various other element, however these arbitrary requirements stop banks from prolonging financing to the debtors.

The Best Strategy To Use For Atlanta Hard Money Lenders

When it comes to the debtor without sufficient work history, they would certainly have the ability to refinance out of the hard money lending and right into a reduced cost traditional finance once they obtained the essential 2 years at their present placement. Hard cash lending institutions provide lots of financings that traditional lenders such as financial institutions have no interest in funding.

These jobs include an investor acquiring a building with a short-term car loan to ensure that the financier can swiftly make the required repair work and updates and afterwards sell the home. atlanta hard money lenders. Most of the times, the investor just needs a year car loan. Financial institutions wish to lend cash for the long term and are satisfied to make a small quantity of interest over a long duration of time.

The issues can be associated with foundation, electric or pipes and might create the bank to consider the residential or commercial property unliveable and incapable to be moneyed. as well as are not able to consider a car loan scenario that is beyond their rigorous lending criteria. A hard cash lender would be able to supply a consumer with a funding to purchase a building that has issues stopping it from receiving a conventional small business loan.

The Only Guide to Atlanta Hard Money Lenders

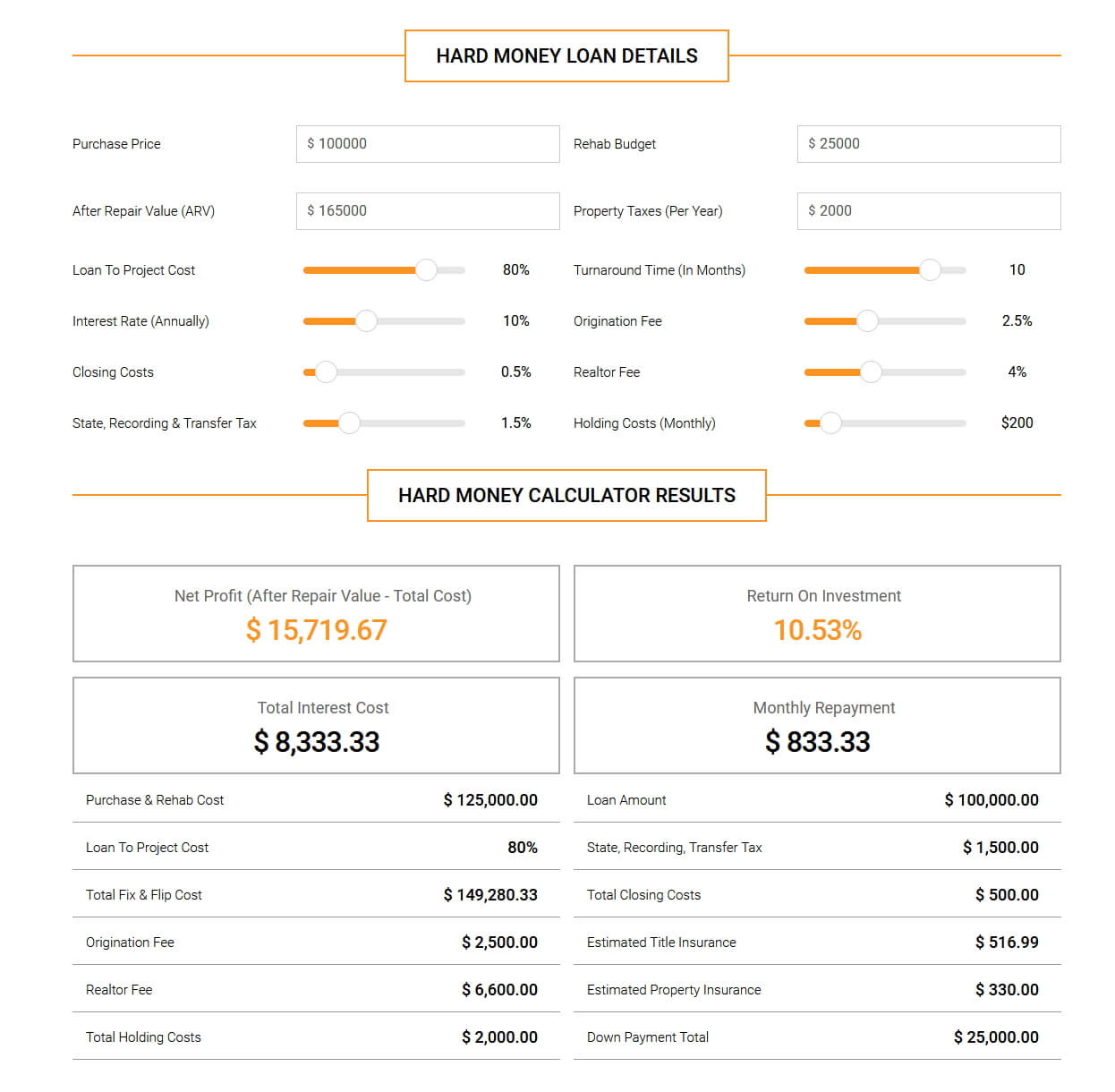

Difficult money lenders likewise charge a finance origination cost which are called points, a portion of the lending quantity. atlanta hard money lenders. Factors usually vary from 2-4 although there are lending institutions that will bill a lot higher points for certain situations. Certain areas of the country have lots of competing difficult cash loan click over here now providers while other locations have couple of.

In big city areas there are usually several more difficult money lending institutions ready to provide than in more remote country areas. Customers can benefit significantly from checking prices at a couple of various lending institutions prior to dedicating to a tough cash lender. While not all difficult cash lending institutions offer second home loans or count on deeds on residential or commercial properties, the ones who do bill a greater rate of interest on 2nds than on 1sts.

Not known Factual Statements About Atlanta Hard Money Lenders

This boosted passion rate mirrors the increased risk for the lender being in 2nd placement instead than 1st. If the borrower enters into default, the first lien holder can confiscate on the home and eliminate the second lien owner's interest in the residential or commercial property. Longer regards to 3-5 years are readily available but that is generally the ceiling for you can try here lending term length.If passion prices drop, the borrower has the alternative of re-financing to the reduced present rates. If the interest rates boost, the consumer has the ability to keep their reduced rate of interest car loan as well as lending institution is forced to wait until the car loan ends up being due. While the lending institution is awaiting the finance to come to be due, their investment in the trust deed is generating less than what they could get for a new trust deed investment at current prices.

A Biased View of Atlanta Hard Money Lenders

This is a worst instance circumstance for the hard money loan provider. In a comparable circumstance where the customer places in a 30% down settlement (rather than just 5%), a 10% decrease in the value of the residential property still gives the consumer a lot of reward to stick to the building as well as task to safeguard their equity.Report this wiki page